Global financial markets were mightily shaken when Lehman Brothers declared chapter 11 bankruptcy. Australian banks took a big hit as did Asian banks across the Orient. Banks across Japan were hammered taking losses between 5 to 20% depending how heavily invested they were in Lehman Brothers, some say up to $700 million for some.

Asian stock markets plummeted Tuesday as the collapse of Lehman Brothers and takeover of Merrill Lynch spurred fears of an imminent global financial crisis. European markets extended losses in early trading after falling sharply Monday.

Tokyo’s Nikkei 225 index sank nearly 5 percent to 11,609.72, its lowest close since July 2005, while Hong Kong‘s blue-chip Hang Seng Index shed 5.4 percent to its lowest point in nearly two years.

America is quickly becoming bankruptcy central as major corporations and governmental institutions go belly up. Fannie Mae and Freddie Mac governmental lending institutions themselves are having difficulty remaining solvent considering all the bad loans and sub-prime mortgage crisis.

Singapore wisely hasn’t tied itself too tightly to the U.S. having a bit of foresight it seems. Others will have to live and learn.

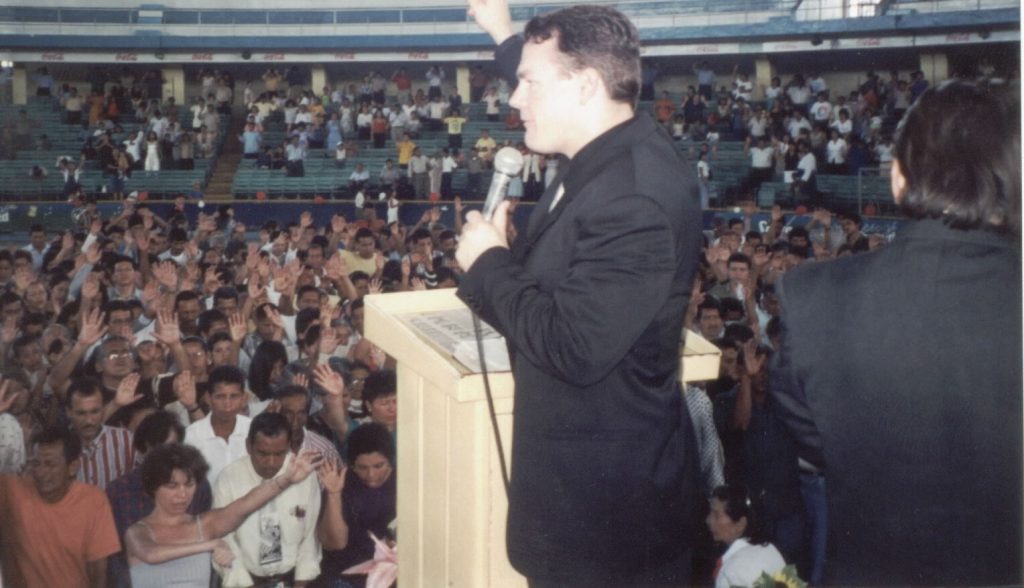

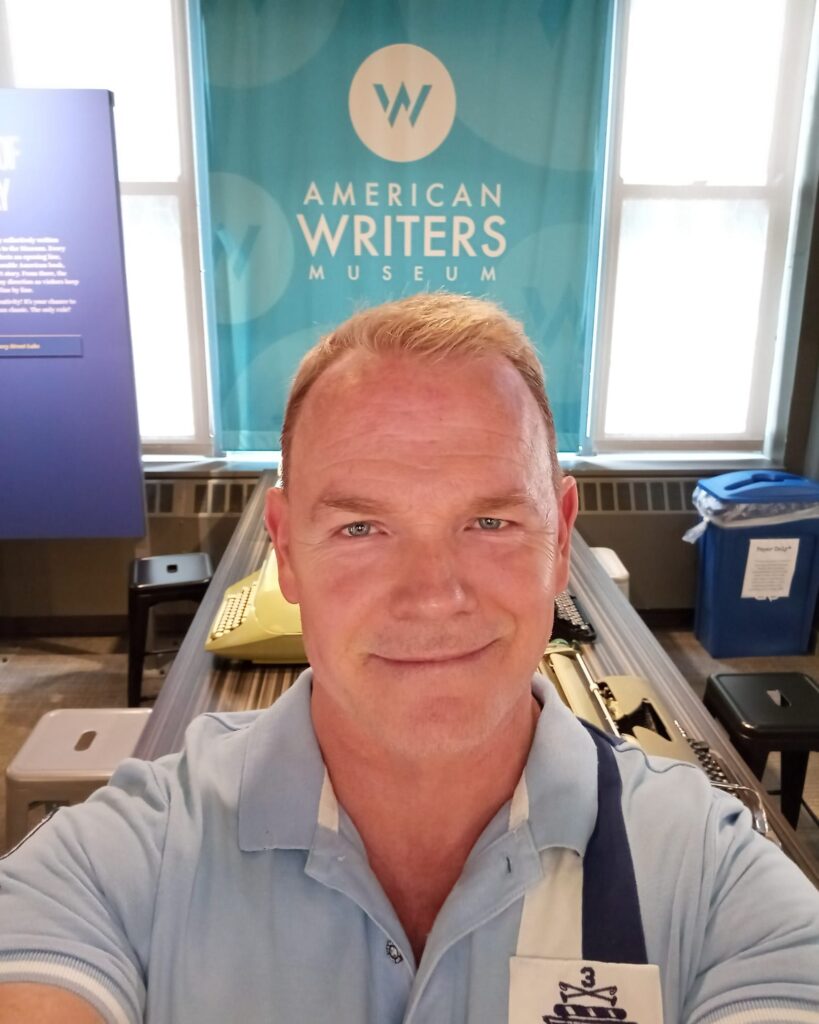

Paul F Davis – debt arbitrator and author of United States of Arrogance