As a global property specialist I am deeply committed to supplying foreign investors interested in buying and owning property in the United States of America the most current tax law as I understand it (and/or recommending the best legal advice within my professional network).

A wise consideration for any foreign real estate investor buying or owning property in the United States of America is to elect to be taxed on a net basis as though the income is connected with a U.S. trade or business.

Upon making this election, changing it thereafter requires IRS approval – not impossible but usually cumbersome requiring some lengthy paperwork, documentation and sometimes skillful legal representation.

Typically a foreign taxpayer cannot switch between taxation on a net basis one year and 30 percent withholding gross basis the next unless authorized by the IRS. Yet all things are possible if you can persuade the IRS.

By failing to file tax returns on a timely basis a foreign investor risks losing the ECI election and thereby makes rental income earned subject to the 30 percent withholding taxation requirement.

Electing to be taxed on a net basis can help avoid costly withholding on gross income and allow for deductions for operating expenses to reduce tax liability. The choice between the net tax election or 30 percent withholding on gross must be considered in the context of the taxpayer’s overall tax liability — both in the United States and worldwide — given the investor’s goals (in regard to citizenship, commerce and domicile).

Instructions for Form W-8ECI, Foreign Person’s Claim of Income Effectively Connected with the Conduct of a Trade or Business in U.S.

Department of the Treasury Instructions for Form Internal Revenue Service W-8ECI (Rev. February 2006) Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business …

http://www.irs.gov/pub/irs-pdf/iw8eci.pdf – 32.0KB

For further information please don’t hesitate to contact me.

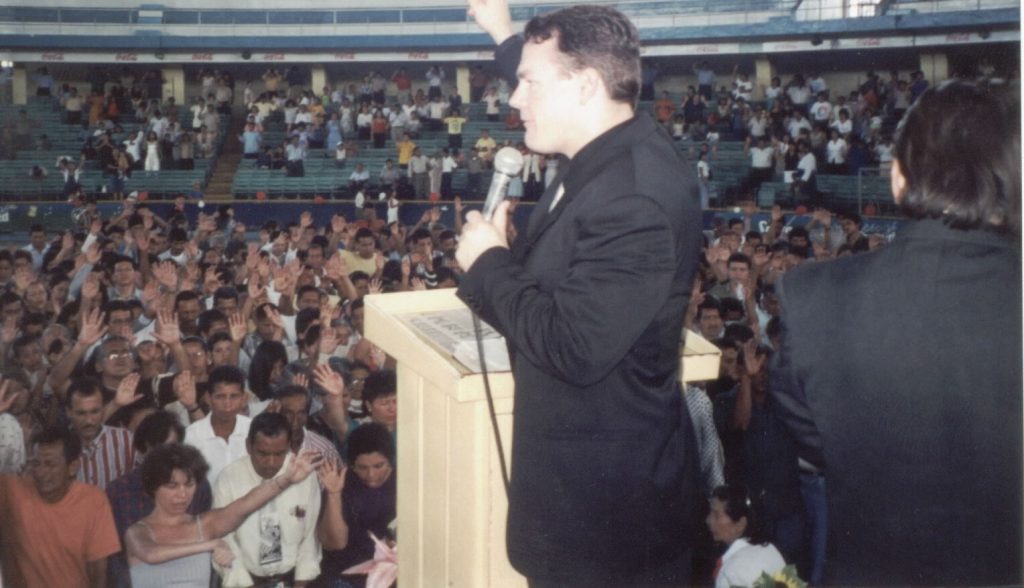

http://www.PaulFDavis.com – global property specialist, debt arbitrator, worldwide speaker and author

info @ PaulFDavis.com

407-967-7553