As I wrote about SunTrust fraud & snake like maneuverings to Florida Financial Services CFO Alex Sink and the Federal Reserve Inspector General Elizabeth Coleman:

No bank governed and regulated by the Federal Reserve should be able to maliciously with the intent to inflict pain and suffering upon customers for inquiries to the Federal Reserve concerning bank practices, be permitted to cancel customer accounts because they do not want Federal Reserve scrutiny and oversight.

On the evening of April 24th I received a letter post marked April 22, 2009 from Sun Trust Bank wherein was written the following by Bank Operations Analyst Sam Fabian of Sun Trust Core Bank Operations:

“…Sun Trust continuously reviews its products, markets, and client relationships to ensure” …they are “meeting our corporate business objectives. There are circumstances where the company will identify a specific account relationship that no longer meets these criteria. In the best interest of …Sun Trust, the company will request that those accounts be closed.”

“Your deposit accounts with Sun Trust are governed by the Rules and Regulations for Deposit Accounts…. As stated in the Rules and Regulations for Deposit, “We may at any time in our discretion, refuse to open an Account, refuse any deposit, limit the amount which may be deposited, return all or any part of a deposit or close the Account without advance notice to the Depositor.”

“In accord with these Rules and Regulations …we find it necessary to discontinue our banking relationship. We must ask that you close the below listed SunTrust accounts by 04/03/2009. If you do not close the accounts by this date, we will close them for you, and …hold the proceeds until we hear from you….”

“…If you have a Sun Trust Check Card, it will become inactive within 10 days of the date of this letter. …In preparation for your account closing, you should begin immediately to make other arrangements for any automated credits to, or debits from, your accounts.”

This cold and cruel letter was signed by SunTrust Core Bank Analyst Sam Fabian.

The unethical and malicious manner with which Sun Trust Bank handled this matter is unjust, fraudulent, and was blatantly intended to inflict the most pain and suffering possible. The letterhead was dated 3/20/2009 but the letter’s envelope in which it was mailed was not post marked by the U.S. Postal Service until April 22, 2009 – a month later.

Meanwhile the local branch manager at Lake Margaret on Semoran Blvd., Orlando, FL the infamous Mr. Louis Satmaria who I had spoken to personally concerning the account in March, 2009 never bothered to inform or forewarn me my account was to be closed. Officer of Executive Services Linda Spain’s letter dated April 21st, which I received in the same envelope with Sam Fabian’s letter from SunTrust came in an envelope post marked April 22, 2009.

So SunTrust Bank intending maliciously to inflict the most possible harm, pain, and suffering on me its banking customer (who filed a complaint with the Department of Financial Services CFO Alex Sink in March, 2009 …a complaint that was forwarded to the Federal Reserve in Atlanta) withheld this vital financial information from me and my family knowing full well what was going on all along.

This way I, a school teacher working for the county school board, who gets paid once a month, at the end of the month, by way of automatic deposit, would not be able to receive payment from my employer for an entire extra month it being on an automated system. Hence I would be unable to be compensated from my employer until May 31st.

Furthermore, SunTrust perfectly timed their letter to arrive late Friday afternoon in the mail so I would be without a bank account and funds all weekend long. No phone call was ever made forewarning me of Sun Trust’s decision to close my account, not by the branch manager Mr. Louis Satmara, nor from Mr. Sam Fabian or Linda Spain.

Before doing business with Sun Trust consider their snake like maneuverings with me, the grandson of a former retired U.S. Army Lt. Colonel who also worked for and retired from SunTrust Bank.

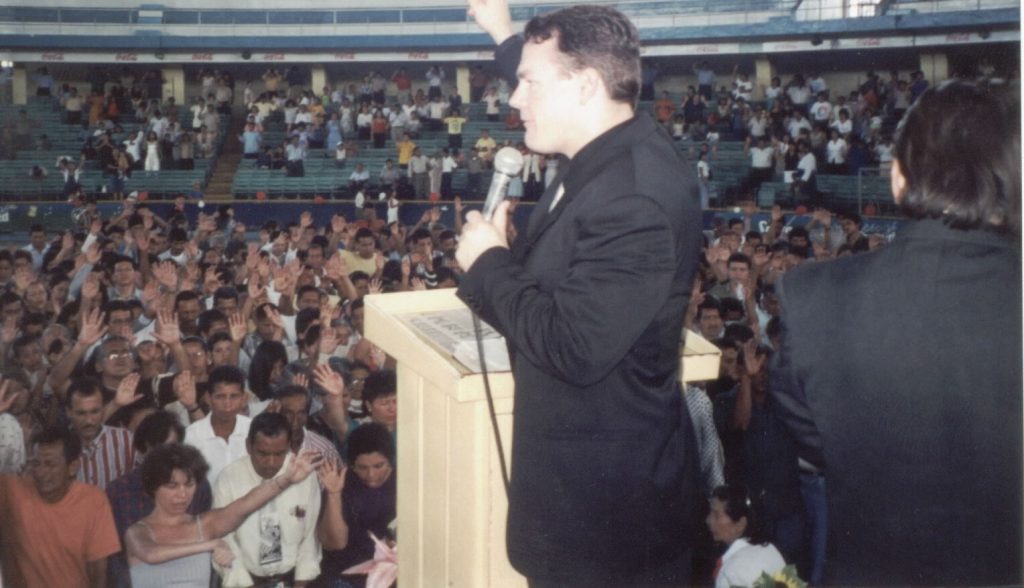

As a minister Sun Trust showed no compassion whatsoever to me. When they closed my account, I had a few hundred dollars for my wife and I to live on until I recieved my next school teacher paycheck. Sun Trust kept my positive balance and never sent me a check along with their cancellation letter.

No bank governed and regulated by the Federal Reserve should be able to maliciously with the intent to inflict pain and suffering upon customers for inquiries to the Federal Reserve concerning bank practices, be permitted to cancel customer accounts because they do not want Federal Reserve scrutiny and oversight.

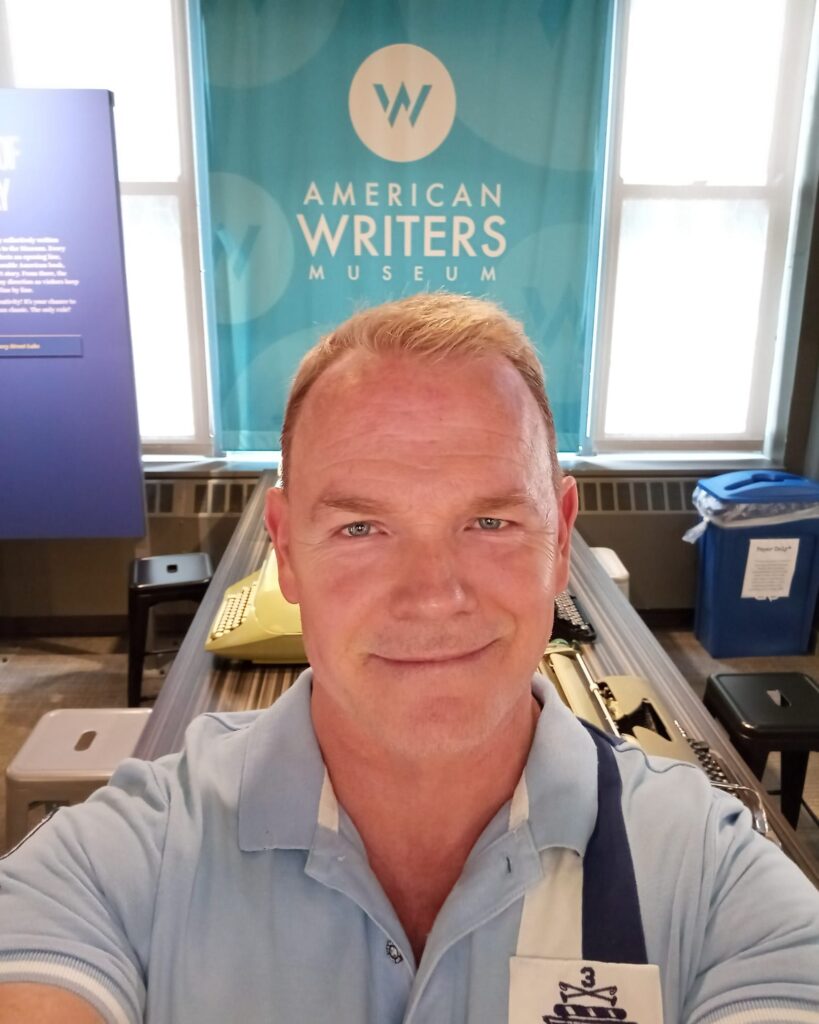

www.PaulFDavis.com – consumer advocate fighting bank fraud, worldwide speaker, life-changing author of 17 books

Invite Paul to speak in your city! – RevivingNations@yahoo.com