Beat your lying & cheating insurance company to get thousands more $$$ you deserve and paid for with your hard earned premiums for years. Get what you deserve from your accident & personal injury claim.

http://www.mindbites.com/lesson/2605-beat-your-insurance-co-get-thousands-more

When I called and signed up for USAA’s insurance I thoroughly asked innumerable questions and was assured everything by the USAA rep over the phone. Among the assurances I received was that of a replacement policy to ensure if ever my automobile was damaged or unsalvageable, I would recooperate the full price to replace it with a similar or like vehicle.

Sad to say however upon testing the actual fact with the verbal promises of USAA reps by way of the phone, it is I the insured who am getting sliced and diced as USAA runs away with the cash. Mr. Chris Gonzalez my USAA Claims Director says my policy is an actual cash value policy not a replacement policy. Sounds like a false, misleading, and deceptive insurance practice to me.

The proverbial bait and switch – promise one thing than deliver a less product and service, while handsomely profiting for years on the unsuspecting insured’s premiums. An all too common trick of USAA’s it seems.

Surprsingly, when I inquired as to replacing my vehicle (which by the way was hammered pretty hard, along with me, thanks to a 47 y/o drunk driver who was taken to jail) I was told by USAA’s Chris Gonzalez:

“We will consider reimbursing the sales tax related to the replacement vehicle or sales tax related to the total loss vehicle, whichever is less.”

Not the underlined portion, which I added for emphasis. When looking for an insurer, here is what you can expect from USAA – “whichever is less”.

Insured beware!

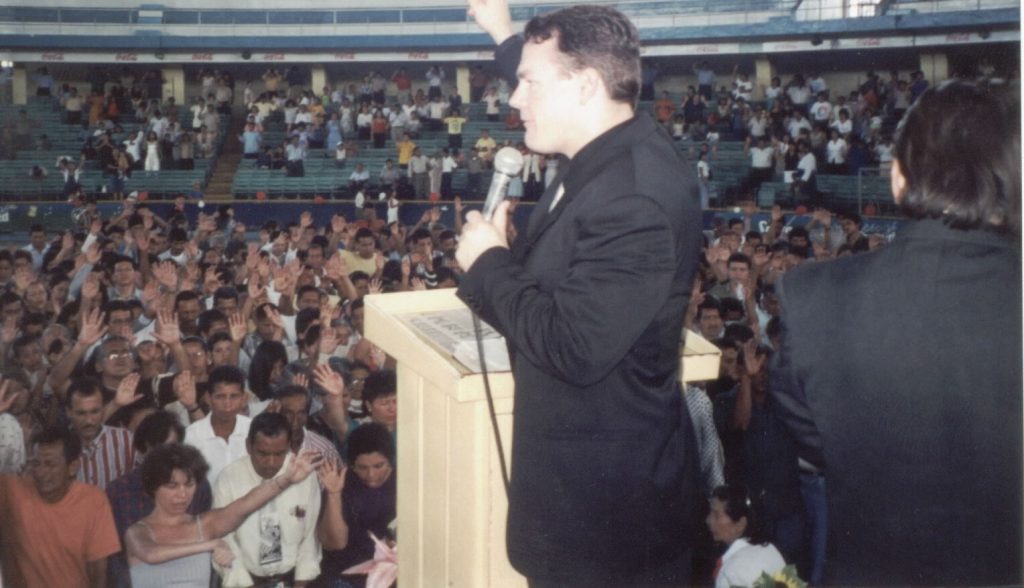

Paul F Davis – consumer advocate and minister